As an Amazon Affiliate, we may earn a commission on eligible purchases made through our referrals. Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

One of the great things about cruising is you can book a long way out. I know a number of readers are already now booking for 2025 to get the perfect cabin for the perfect cruise. I myself am not that far out but much of 2024 is booked with only 2 more to fill in when I have solid dates that can work.

Once you have your cruise booked, even if you paid for it in full with say Chase Ultimate Reward points, it is time to start to look at other options to improved your experience. For example, NCL allows you to load $1,000 per cabin into your account and it is FULLY REFUNDABLE at the end of the cruise. When you pair this with offers that often come up with AMEX that if you spend “X” dollars you get “X” dollars (or points) back it can become a fantastic deal.

But there are also many smaller deals as well. Let me explain.

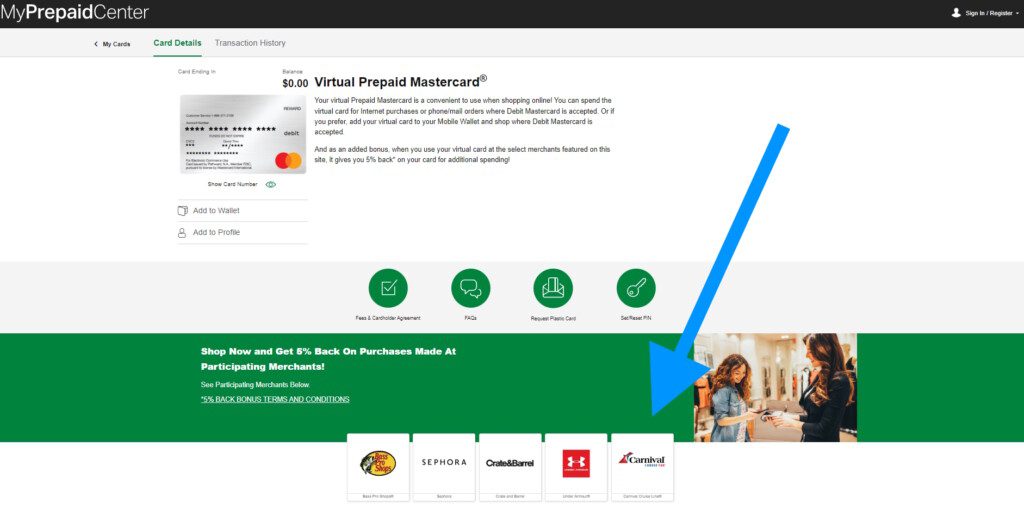

I am a big fan of Swagbucks (link to sign up free). There are many times they offer the best value as a shopping portal compared to others like TopCashBack or Rakuten when buying stuff. They also often times have large point offers for say opening a checking account and so on. The result is I always have a large pile of Swagbucks and 99% of the time only redeem them monthly for a discounted $25 e-Mastercard. OK then what?

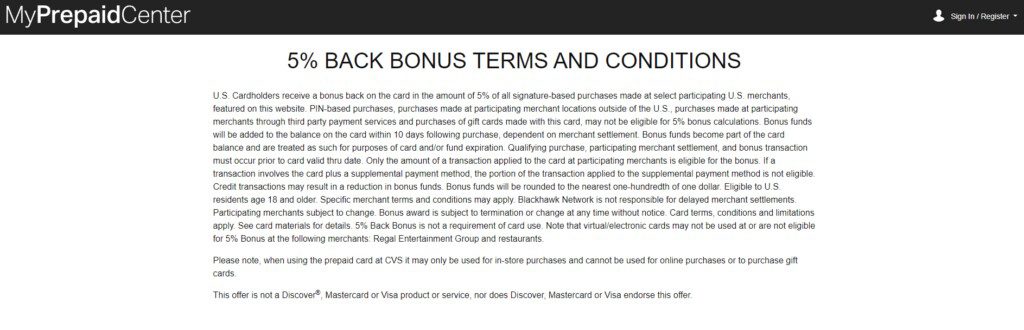

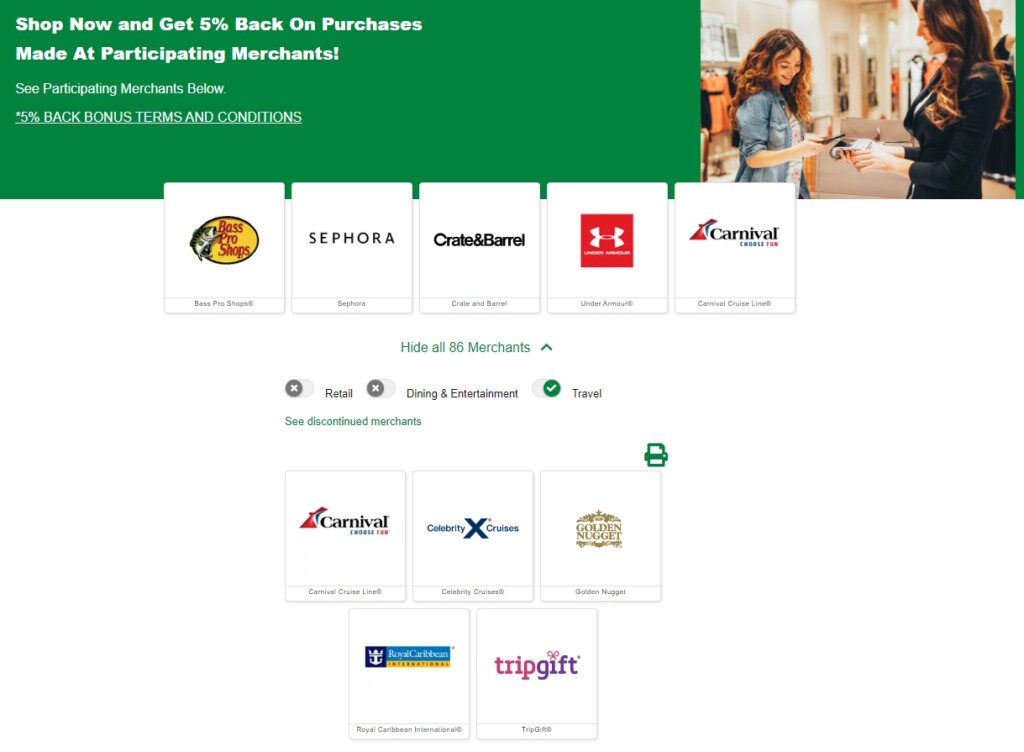

These cards act like “5 back” cards when you spend them at certain stores. Not just stores but there are a number of cruise lines included as well.

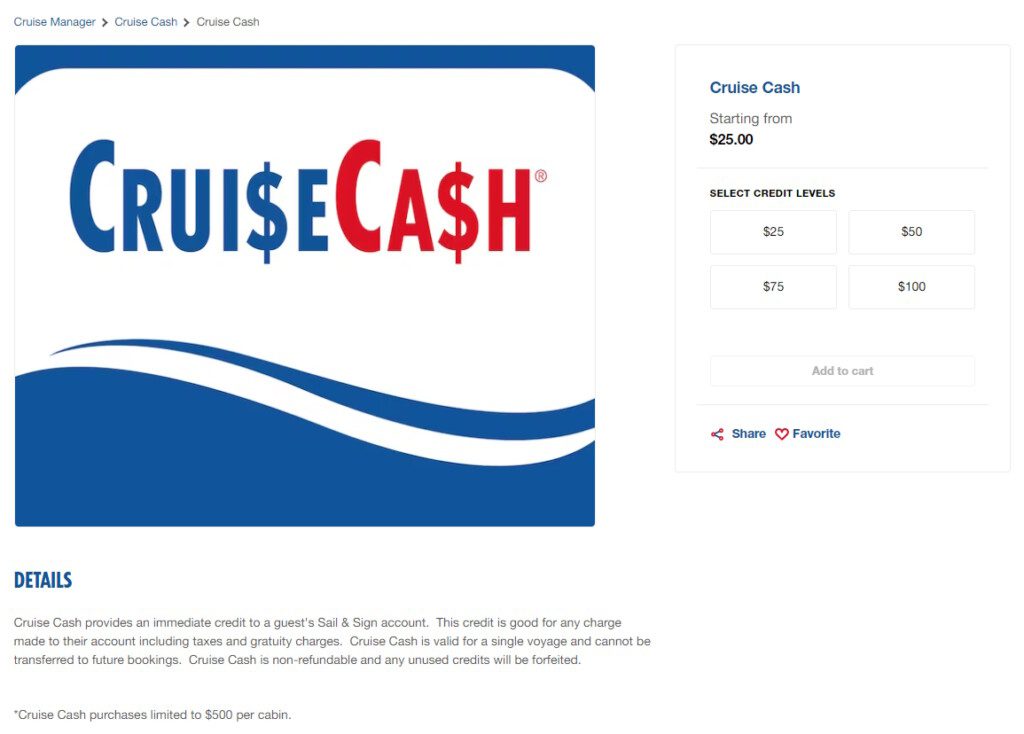

With a Carnival cruise booked for next year I am in need of some onboard cash so both my wife and I each month are applying one of our $25 free e-Mastercards for onboard credit. Yes it takes time to load just $50 per month but it is free money and over time I will max out the $500 allowed.

There are a number of other cruise lines included in the 5 back offers but I am not sure they are as simple to use as Carnival (RCI you have to call to load onboard credit for example).

Lastly, what to do with the tiny $1.25 that loads back onto your e-Mastercard? We dump them onto our cell bill or cable bill as they do not charge a fee to pay with a credit/debit card and don’t mind tiny amount payments.

Folks, it all adds up over time when it comes to a cruise and every dollar saved is one less you have to pull out of your pocket. This plus free air via card points and free hotels via card points all can soften the blow and make your next cruise one that is not only amazing but affordable as well! – René

Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.