As an Amazon Affiliate, we may earn a commission on eligible purchases made through our referrals. Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Since jumping into the waters of miles, points, travel, and credit cards, I’ve grown to love bank loyalty programs with flexible and transferrable points.

I’m talking about American Express® Membership Rewards®, Citi ThankYou Points, Capital One Miles, and one that should be part of everyone’s points or cashback strategy: Chase Ultimate Rewards®.

People always ask me, “What’s the best credit card to get?” The answer is not a one-size-fits-all situation. Everyone’s travel goals, preferences, and budgets are unique. But one of my responses almost always is something like, “Do you have a Chase Ultimate Rewards® card?” (For those interested in the answers, I find a lot of folks hold either the Chase Freedom Flex® or Chase Freedom Unlimited®).

(All information related to the Chase Freedom Flex® was collected independently by Frequent Floaters and was neither provided nor reviewed by the card issuer.)Look, I love me some Membership Rewards. And Capital One is really stepping up its game. I’m eager to see what else Citi does to give ThankYou points a bit more oomph. But Ultimate Rewards can save you a handsome chunk of change on your cruise and cruise-related travels. Plus, they offer a bevy of no-annual-fee cards that can bolster your travel card arsenal. Let’s take a look.

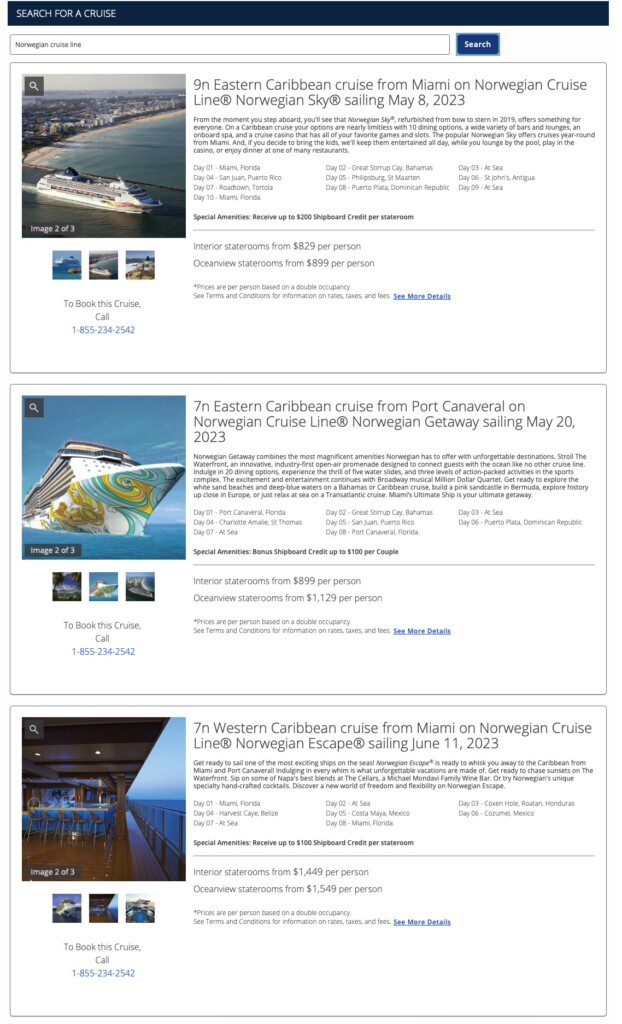

Increased Redemption Rates on Travel Booked Through Chase

You can book all sorts of travel through Chase Travel℠. Points can be applied toward purchases at one cent per point. For example, 50,000 points are worth $500.

Is that anything special? Nope. I can do the same with my other credit card loyalty programs at the same rate.

But here’s where things get interesting. Three Chase cards allow cardholders to redeem those points at higher values when booking travel through Chase Travel℠:

- Chase Sapphire Reserve®: 1.5 cents per point

- Chase Sapphire Preferred® Card: 1.25 cents per point

- Ink Business Preferred® Credit Card: 1.25 cents per point

Big deal! some may say. A whole half a penny on the Chase Sapphire Reserve®! Ooh. Ahh.

Well, “ooh! Ahh!” is kind of on point. Consider those 50,000 points we talked about a minute ago are now potentially worth $750. I didn’t finish at the top of my math classes, but I’m pretty sure (correct me if I’m wrong) $750 is worth more than $500. That’s with the Chase Sapphire Reserve®, which carries a $550 annual fee. But that’s fairly easy to earn back. It comes with statement credits galore for travel, DoorDash, and Instacart. Plus, the 1.5X redemption rate alone can save you significant money.

In fact, after his MSC status match, René booked and 100% paid for an 11-day cruise on Ultimate Rewards points at 1.5 cents each.

And, yes, you earn your cruise loyalty points, nights, etc. (including bonuses for suites) when booking through Ultimate Rewards Travel.

Airline Tickets

Many of us need air travel to our embarkation port. (Most of those living close to a port will volunteer that information before you ask them 😉 ).

Not paying for those airline tickets sure is nice, right?

You can purchase airline tickets through Ultimate Rewards Travel and redeem some or all of your points (and any balance with cash, of course.) The Chase Sapphire Reserve® features up to $300 in annual statement credit for eligible travel purchases. “Travel” encompasses a lot: airline, hotel, cruise, rental car purchases, parking, and ride share are just a few.

(I’ll never forget when a Chase Sapphire Reserve®-holding friend called me in tears after booking a $1500 airfare to Asia — one of her bucket list destinations. It cost her nothing after she cashed in 100,000 Ultimate Rewards points. “This is so awesome!” she squealed.)

Because these are cash fares — even if you pay the entire thing with Ultimate Rewards points — you’re eligible for any elite status perks and earnings. (Just make sure to include your airline program number!)

Or you can transfer Ultimate Rewards points (in multiples of 1,000) to one of their airline partners:

- Aer Lingus AerClub

- Aeroplan

- British Airways Executive Club

- Emirates Skywards®

- Flying Blue (Air France-KLM)

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

Know ahead of time that some point transfers are relatively quick (within a minute or so) or not. It once took a few days for Ultimate Rewards points to port over to Southwest — and the airfare went up by them. But another time, the transfer worked great.

Hotel Nights

Just like those precious few who live a reasonable distance from the port, some of us must spend a night or two on either side of our cruises. Some people love Airbnb or VRBO. If you’re like me, hotels are the way to go.

Again, you can use your Ultimate Rewards points to purchase a hotel stay — but you won’t be entitled to elite status benefits or earnings. (Hotels and Online Travel Agencies have kind of a complicated relationship.)

Luckily, Ultimate Rewards partners with several major hotel brands:

- IHG® Rewards Club

- Marriott Bonvoy™

- World of Hyatt®

Now that Marriott swallowed up Starwood and Hyatt exploded into 22 different brands, you should be able to find somewhere decent to stay before your cruise. Heck, I’m fine with a decent IHG property!

The Half Reason: Cashback

I did something radical during the ugliest throes of the COVID-19 lockdowns: I applied my points for cashback. I wasn’t going to travel for a while and, well, my family needed to eat. As Yogi Berra said in a commercial:

Chase introduced something called “Pay Yourself Back,” a promotion that allows cardholders to redeem points at increased rates toward certain categories. It varies by quarter — though “Charitable Donations” seems pretty evergreen.

“So, Smarty Pants, Which Card Should I Get?”

Here’s what I do: I have the Ink Business Cash® Credit Card and the Chase Freedom Flex®.

The Chase Freedom Flex® has a $0 annual fee. It offers 5% cashback (5X Ultimate Rewards points — redeem as you see fit) on select purchases each quarter, up to $1500 in combined spending. (All information about the Chase Freedom Flex℠ has been independently gathered by Frequent Floaters and not reviewed by the card issuer.)

You must manually enroll each quarter but that takes, like, five seconds.

But here’s where that 5X becomes potentially more lucrative. I can transfer those points to my — and then they may ultimately become worth 7.5X through Chase’s travel portal.

My wife has both the legacy Chase Freedom (not available for new applications), which essentially became the Chase Freedom Flex®.

Plus, as our corporation’s secretary, she saw fit to get the. Ink Business Cash® Credit Card. That card is a must for most small businesses. It earns 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Plus, it earns 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year.

(Don’t forget to register your cards with Payce!)

Warning: 5/24

Chase has something known colloquially as “5/24.” This means that Chase will automatically deny a credit card application from someone who has been approved for five (or more) cards by any bank within a rolling 24-month period. “Any bank” means just that: American Express, Citi, Capital One, etc.

So, there’s that.

Final Approach

One of this blog’s big focuses is cruising on trips paid for with points and/or other elite status or credit card perks. (There are shirts for that!)

If you can survive the 5/24 edict, Chase Ultimate Rewards can be a gold mine for cruisers. The earning and redeeming structures are especially appealing.

Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hi Chris, Your article needs a bit of re-editing. The names of the specific Chase credit cards are omitted.

@Lenny – I can tell you my pattern. I hold Ink Cash and maximize at Office Depot and Staples. Then Freedom Q bonus offers plus Freedom Unlimited at CVS etc. Send all to Chase Sapphire Reserve for booking sailing getting 1.5 cents value for all the points!

Yeah, I noticed and am working on it, thanks. Our affiliate is trying out a new linking system.

It’s better using pay your self back at 1.5 when it was available rather than redeeming on travel. You can earn points when using a credit card and earn onboard credit as well

@Rick – PYB is much more limited now at much lower rates. Before when growcery was 1.5 what you said WAS true – not now. Travel redemption once again big value.