As an Amazon Affiliate, we may earn a commission on eligible purchases made through our referrals. Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. All information related to any credit cards below was collected independently by Frequent Floaters and was neither provided nor reviewed by the respective card issuers.

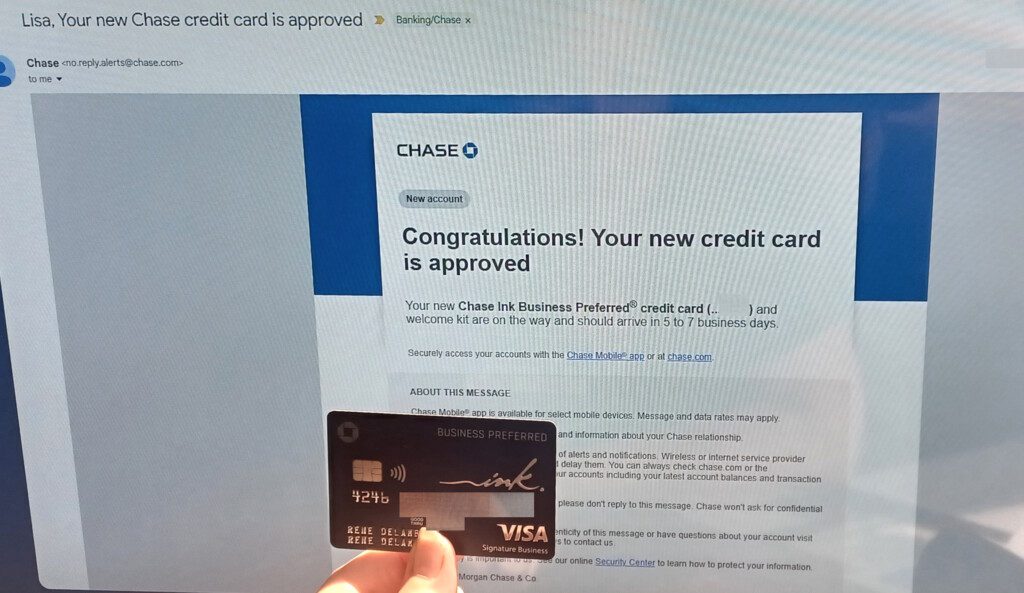

I love it when a plan comes together. You see, right now, the Ink Business Preferred® Credit Card card features a welcome bonus of 100,000 Chase Ultimate Rewards® points after spending $8,000 on purchases within the first three (3) months of account opening.

While $8,000 may seem like a bunch, and $16,000 for both my wife and me combined, the old minimum spend threshold on this card was $15,000. So, this is clearly much better and doable for us with bills and “other” spending.

Please note: turning off your ad blocker should do the trick if links don’t correctly display or you can’t click them. This enables you to see and access the content — and you also help support Frequent Floaters. Thank you!

Here are some things to keep in mind before you, like us, both go for this card. This card IS subject to the Chase 5/24 Rule, that is, most times, you will not be approved for the card if you’ve opened five or more new card accounts in the past rolling two years.

This card offers nice earnings that are 3X in the following categories:

- Travel (including Uber etc.)

- Shipping purchases (UPS etc.)

- Internet, cable, and phone services (we all have phones)

- Advertising purchases made with social media sites and search engines (Not a big one for me)

There is a limit of $150,000 spend for this 3X bonus, and it resets at the 1st of the year each year no matter when you get the card. (You earn 1X on each eligible dollar after reaching the $150k threshold.) Also, there are no foreign transaction fees, so it’s a safe card to use when traveling.

If you only have this card, then points can be redeemed for 1.25 cents each toward the cost of a travel purchase through the Chase Ultimate Rewards Travel Portal. Or, you can do like me and send them over to your Chase Sapphire Reserve® card and spend them at 1.5 cents each toward the cost of a travel purchase through the Chase Ultimate Rewards Travel Portal for, say, a cruise booking (SCORE)!

What this means is once I am done with the 16k spend (8k each), my 200,000 Chase Ultimate Rewards points would be worth $3000 in cash toward a new cruise booking via the Chase travel partner (you do have to call, FYI).

The Chase cruise booking partner can offer you all the same deals you can find booking direct through your favorite cruise line, so you will not miss out on any sales or deals they have going at the time of booking.

You can also transfer points 1:1 to many airline partners if you need to fly to get to your cruise. Should you need to, you can also send them to hotel partners as well, like Marriott Bonvoy, World of Hyatt and IHG One Rewards.

Bottom line for me is this is a HUGE approval score for BOTH my wife and me — and now it is time to start planning where I am going to spend this treasure trove of very valuable travel points! – René

Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Rene, welcome to the club! This is one of my favorite cards to book non-airfare travel, including cruises as well as to use as my card for onboard charges as they all earn 3x points. This card offers better return-on-spend for cruises than almost any other card on the market.

Are you still relying on Buying Groups to meet the spend? Nearly every order I’ve placed has been cancelled. What workaround has worked for you in using buying groups (or are you deemphasizing buying groups in favor of other techniques to meet these high spends)?

@Peter – Nah. There are many locations that sell cards I use 😉

Plus this time of the year I have some large yearly bills to pay like my homeowners insurance and car for the year. Plus pre-pay utility’s etc.