As an Amazon Affiliate, we may earn a commission on eligible purchases made through our referrals. Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Curious to see which credit cards you might actually qualify for without going through the whole approval process — but don’t want a “ding” on your credit report?

We recently started working with a company offering a tool called CardMatch™. Their partners include credit card issuers such as American Express, Chase, Citi, Bank of America, Discover, and Wells Fargo.

As people who love loyalty program rewards and technology, we think this is pretty cool. (CardMatch™ has been around for a few years, but we recently started learning about it)

My phone blows up and my email inbox goes ballistic whenever I apply for a credit card or am added as an authorized user to a family member’s account. The credit monitoring companies sent me (much appreciated) alerts letting me know something was up.

Never once did I receive a credit monitoring alert when using CardMatch.

Here’s how it works:

- Visit the CardMatch™ page.

- Click or tap “Find my matches.”

- Fill out the requested information.

- Name

- Address

- Income

- Employment status

- Select which types of bank accounts you have

- Last four digits of your Social Security Number

- Submit the information.

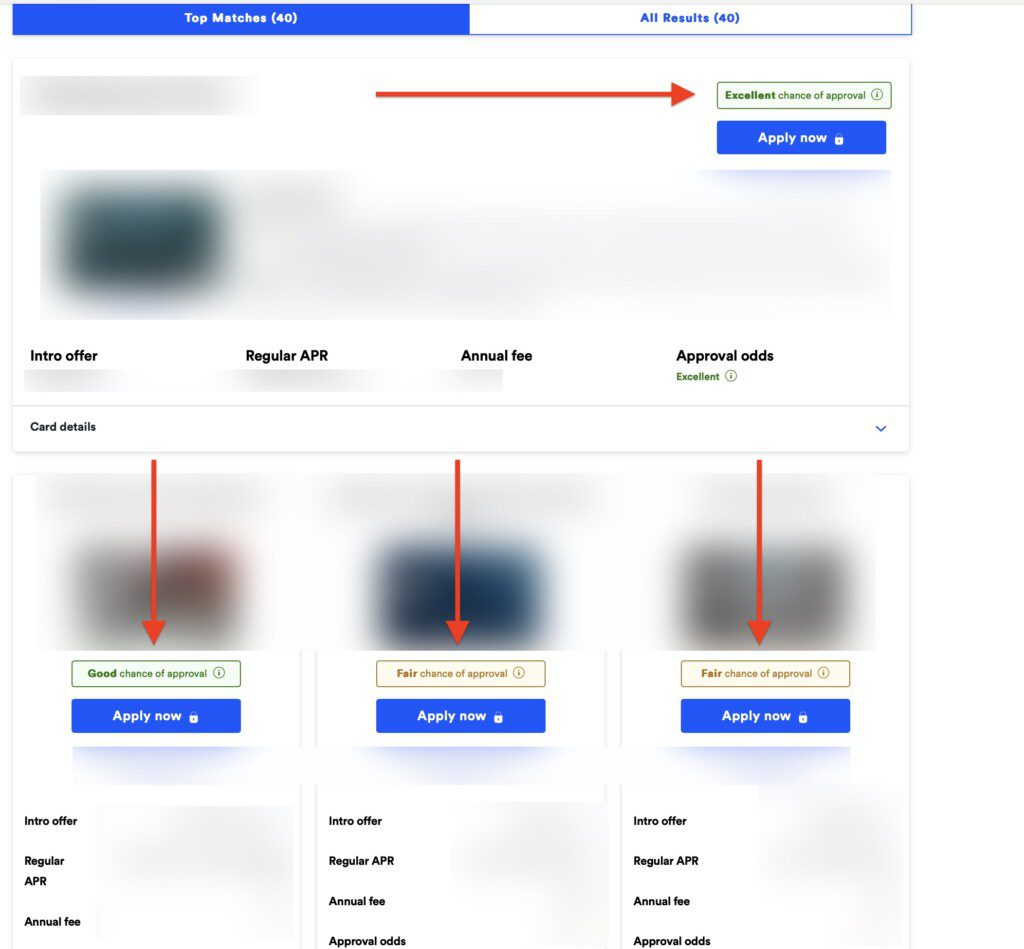

You’ll soon see perhaps up to a couple of dozen cards that CardMatch™ thinks you have a chance of getting approved for — and the likelihood of each.

The Final Answer?

Use these results as guidelines. They aren’t black or white. An “Excellent” chance of approval isn’t a guarantee that you’ll be approved, though it seems pretty likely.

Similarly, a “Fair” doesn’t mean you’ll automatically be declined. It depends on your risk tolerance.

(Note: “Guidelines” aren’t the same as absolute rules or laws. Think of “guidelines” as advice or informal rules. A former partner of ours didn’t understand that “guidelines” aren’t binding terminology.)

Worth Noting

Here are a few points (no topic-related pun intended) you should know.

- First, CardMatch™ seems to be available only for personal/consumer credit cards.

- Next, offers may not be available to all users.

- You’re safe: we don’t see any information you provide CardMatch™. We aren’t privy to your name, address, income, mother’s maiden name, pet’s name, pet’s maiden name…

- Finally, may receive a commission if you’re approved for an offer through CardMatch.

Time to Set Sail

If you’re curious to see some of the rewards cards you might be approved for, check out CardMatch™. Their guidelines for which offers they think you’ll get approved for could be valuable.

Advertiser Disclosure: Frequent Floaters is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.